I tend to reflect on the idea of habits pretty often.

Last week, I came across a tweet by Chris Ciovacco, Founder & CEO Ciovacco Capital Management, that touched on the idea of bad habits. With behavioral economics becoming an increasingly popular topic of discussion in the finance world, I’ve found the social chatter on behavioral finance to be quite constructive. Habits are pretty powerful and in most cases a subconscious process in people. Just think, this is why companies want to have consumers form habits with their products/services (increased retention).

We, as humans, have a tendency to use habits as mental shortcuts. While habits can start off as deliberate behavior, through repetition they become automatic. In understanding the power of habits through my interest in consumer psychology, I’ve come to consciously form some good ones - whether that’s going to the gym, tracking my personal expenses, and taking time out of my week to write on here. That’s not to say I don’t have bad habits. At the end of the day, I’m aware that I’m a creature of habits - both good and bad.

How Do Habits Work?

According to Britannica.com, a habit is “any regularly repeated behaviour that requires little or no thought and is learned rather than innate”.

The habit loop is a cyclical process in which behaviors become automatic. In the first step of the habit loop, we have a trigger that serves as a reminder of our routine. Triggers can be external, in which the information for what to do next is within the trigger itself, or internal, in which we decide what do to next through internally stored information formed through associations in our memory. For example, some internal triggers could be associating 6pm with dinner time or your personal office as a productive work space.

Following the trigger is the physical, mental, emotional behavior that’s part of the routine. Finally, the reward is the feedback that tells you whether the routine is good or bad. Through the associative learning and repetition (conditioning), we create direct links in our memory between a trigger and response and make an association between a particular behavior and a consequence. The more we repeat the process, the stronger the association and more automative the behavior becomes.

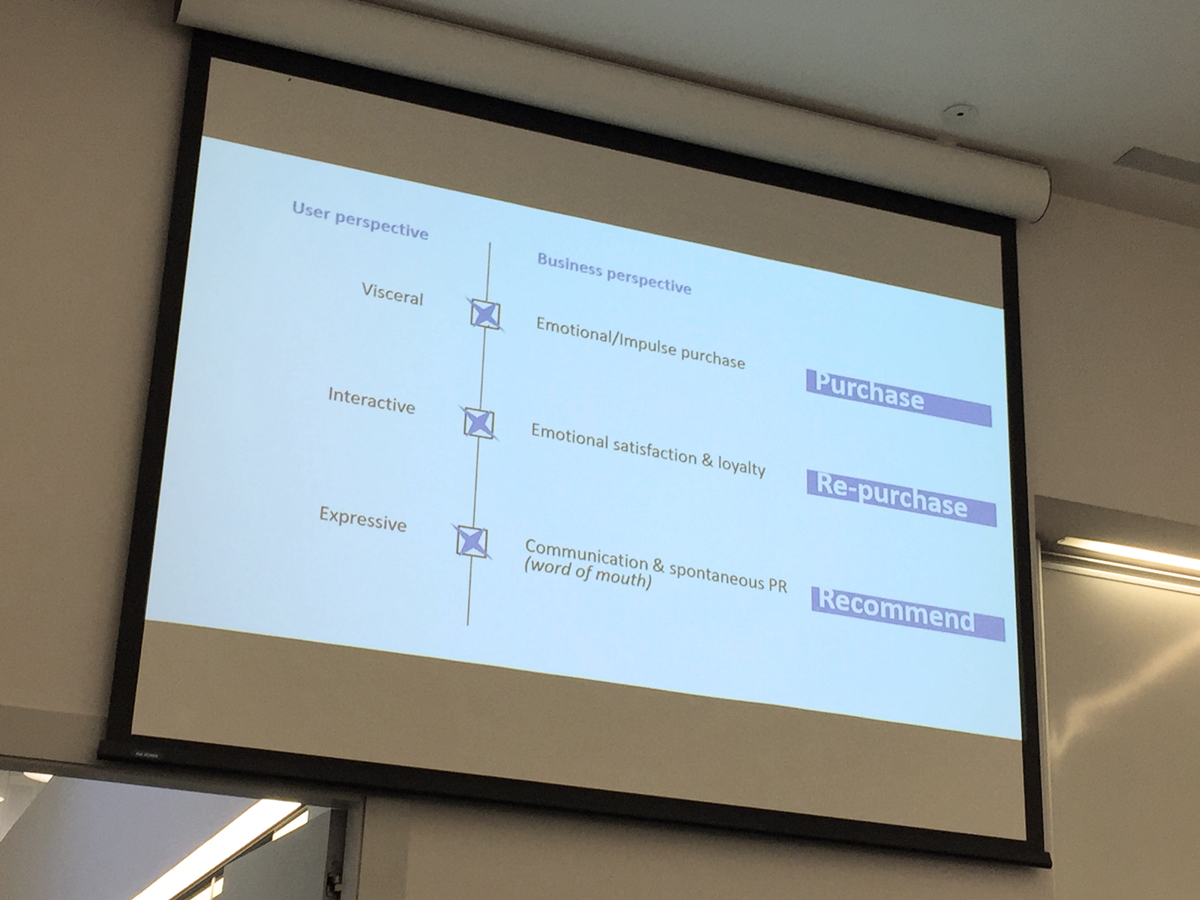

A lot of our purchase decisions are based on habits. Heck, just last night I purchased my usual pre-workout supplement off of Amazon because 1) I didn’t want to invest the time to research a new and potentially better supplement and 2) it was after a long day of work and I felt mentally drained. One of the main focuses for a business is to have potential customers try their product/service to have them become repeat buyers. Having customers form habits with your product/service should be the ultimate goal, as it has the potential to benefit the businesses bottom line. Again, pretty power stuff.