I’m a religious consumer of the Digital Music News podcast.

Source: Statista

About two weeks ago, I caught the latest podcast episode, which focused on the growth potential of the Latin American digital music market. The featured guest was Oscar Castellano, CEO of Americas for Deezer, a French subscription-music service like Spotify or Apple Music. To be quite honest, before working in the music industry, I don’t recall hearing about Deezer. As it turns out, it’s quite the major player in the music streaming space.

According to a streaming service review, Spotify has more than 30 million songs in its library, which reaches 58 countries, while Deezer has 40 million songs that reach more than 180 countries. In the race for emerging market market share, Deezer recently announced a distribution partnership with Rotana, a Dubai-based media company in the MENA region.

All this said, I thought I’d be interesting to give Deezer a spin and see where the value proposition lies.

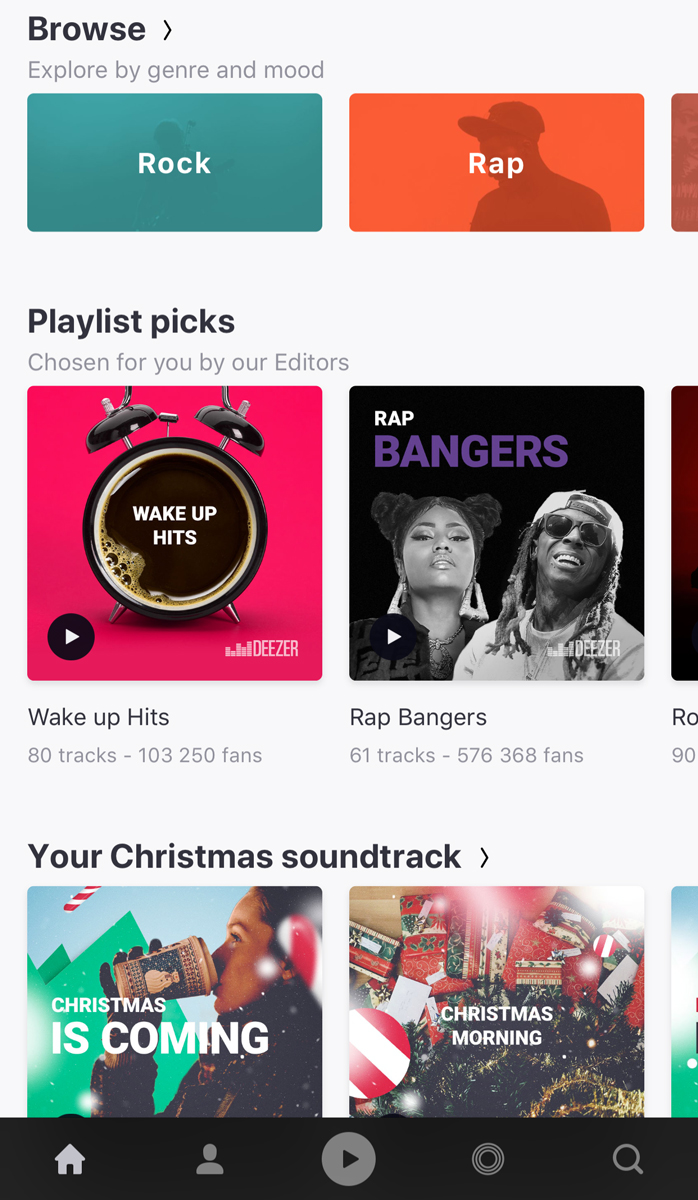

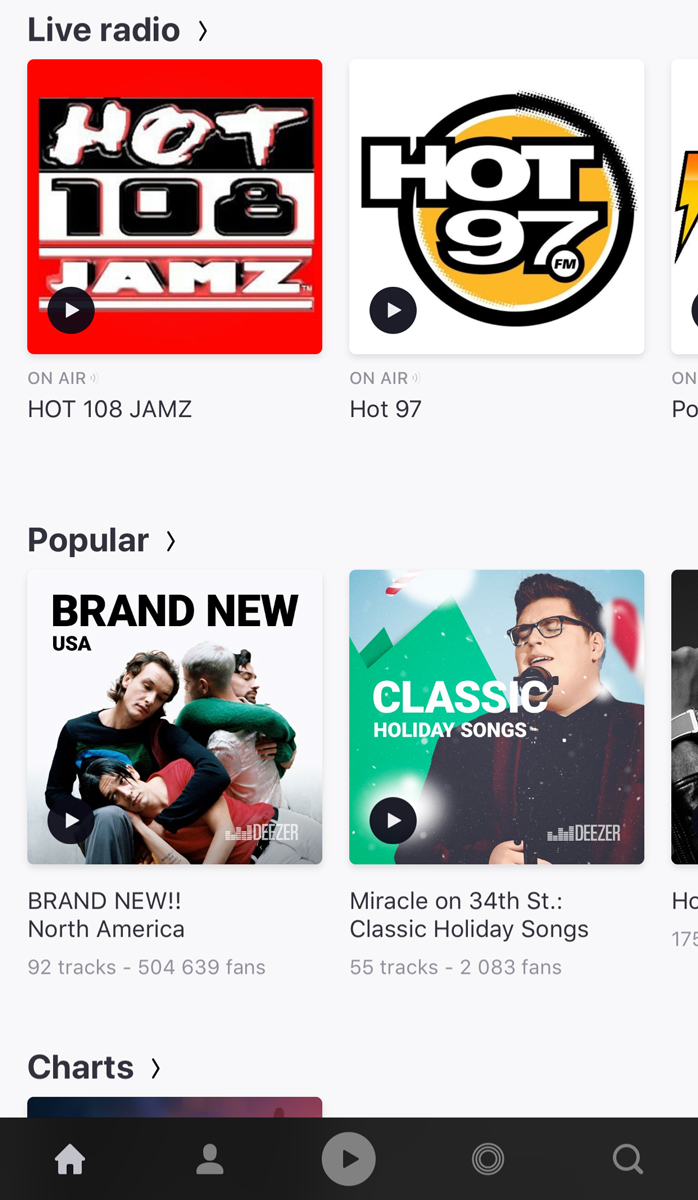

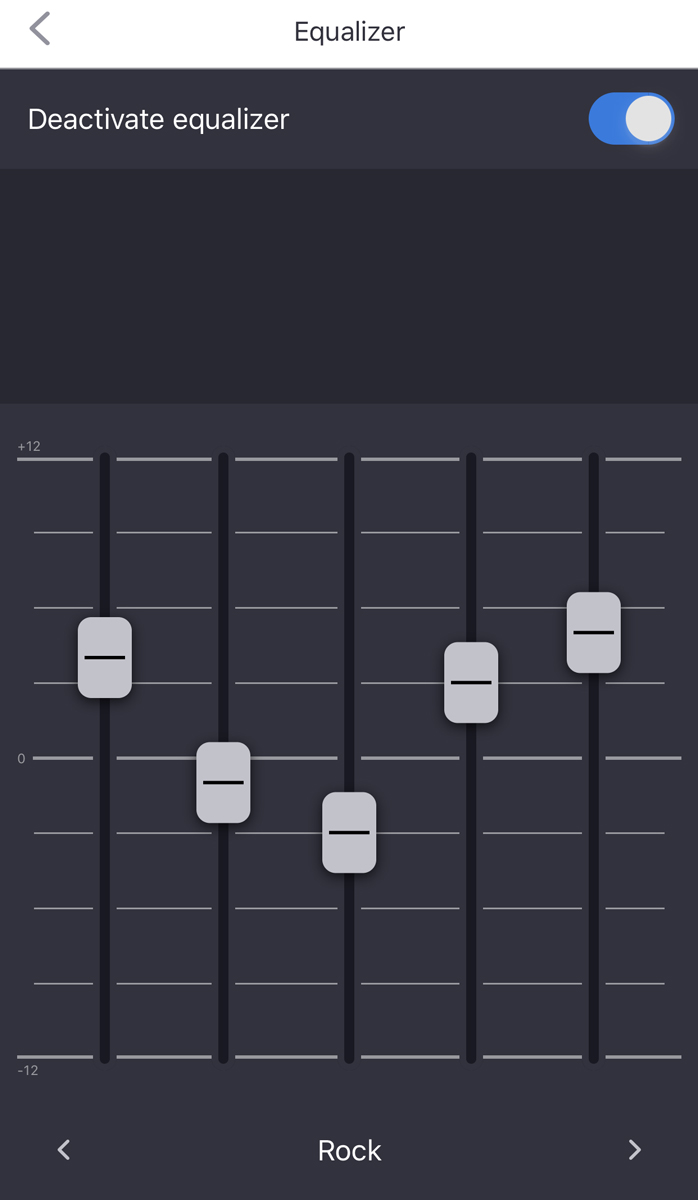

Right off the bat, two things stood out to me on the home page of the Deezer mobile app: My Flow and live radio. My Flow is essentially what My Mixtape is to YouTube’s music streaming platform. In my opinion, the discoverability aspect was mediocre. I felt that about 20 minutes into listening, My Flow would repeat an artist that was previously streamed. I’m personally a bigger fan of YouTube’s My Mixtape. The live radio option was pretty interesting. I haven’t used it much, but could see myself use it frequently when at work or commuting to/from work (especially the KEXP station). I’m extremely curious as to what Deezer’s profit margin is for the streaming of these live stations. After exploring the app a bit more throughout the last few weeks, I found that Deezer lacked a bit in the music library aspect (to my disappointment, the T. Rex library was missing the essential Electric Warrior album). In my opinion, Deezer’s unique selling proposition (other than its diverse set of audio content), is its audio quality and control. Much like Tidal’s value proposition (with the exception of ALAC which Tidal includes), Deezer offers 320 kbps MP3 audio on their Premium tier and 1411 kbps FLAC HiFi tier. The expansive selection of audio content and the control of audio quality looks to be a more affordable version of what Tidal offers to audiophiles.

In the above-mentioned Digital Music News podcast episode, Oscar Castellano, detailed that My Flow was going to play a significant role in the expansion of Deezer in LATAM. I could see that, along with its diverse selection of audio content, being vital motivators for LATAM consumers to select Deezer as their one-stop shop for music/audio streaming consumption. I’ll be keeping a close eye on the Deezer LATAM market share, that’s for sure.